SBA Loan for Commercial Property And Business Expansion: A guide to SBA Financing

Unlock Your Business's Potential With

Expert SBA Loan Guidance

SBA 7(a)

The SBA's most flexible kind of loan, it can be used to purchase inventory, working capital, refinance debt, or buy commercial real estate and equipment.

*Includes SBA loan program

SBA 504

Intended for small businesses that need long-term capital investment to help spur the development or modernization of new facilities or long-term machinery.

Certified Development Companies (CDCs) play a crucial role in SBA 504 loans, typically funding 40% of the loan and emphasizing their nonprofit status and community development focus.

Working with a certified development company is essential to navigate the loan application process effectively.

Normally, the borrower is expected to put in 10%.

SBA Microloans

Microloans are small loans with maximum loan amount not above $50,000, an average loan amount of $13,000, and are issued for start-up and expansion, then managed through local, community-based organizations.

At Commercial Loan Link, we realize that the right type of funding is important for business growth and maintaining stability.

As SBA loan brokers with a lot of experience in the field, we specialize in negotiating the maze that represents SBA loans and are after the most suitable options for all your needs anywhere in the USA, including specially tailored SBA loan for commercial property, SBA loan for gas station, SBA loan for franchise, SBA loan for storage units, SBA loan for laundromat, SBA Community Advantage loan, SBA loan and SBA Boost Loan programs.

Whether it is for expansion or refinancing, or you want to start on a new clean slate, we shall be there beside you to guide you through the lending landscape, ensuring you are offered the best possible funding solutions.

Commercial Loan Link is your commercial mortgage broker, helping you make sense of which loan program works best for the scenario of your small business and how to successfully work through the process of getting a loan. More importantly, the intent behind the process is to ensure that the business owner is not just applying for an SBA loan for small business; but rather, has the best strategy to use the capital to maximize a net gain.

If you are ready to take your company to the next level with an

SBA loan broker, contact Commercial Loan Link. We can help you release the financial resources necessary to drive success within your sector. Reach out now to learn more about how SBA loan brokers can support small business growth aspirations and help you secure the future of eligible businesses.

Navigating SBA Loans Made Easy

With Professional Broker Help

It is such a difficult field to navigate the world of SBA loans, but Commercial Loan Link makes everything turnkey and easy.

We are a committed brokerage and focus on guiding business owners through the small print and the daunting process of securing SBA loans to meet the specifics and get the funding they need to have their businesses flourish.

Understanding if an SBA loan is right for your company includes examining your needs and the structure of your business.

Generally, you are required to meet some eligibility requirements before you can get an SBA loan:

Operate in the United States: Your business must be based in and be operating in the U.S. or its territories.

Demonstrate Repayment Ability: It typically required to show that your business is making sufficient cash flows to cover loan payments.

For-Profit Status: Generally, SBA loans will only be provided to for profit business, although there are some exceptions, such as certain forms of microloans.

Clean Government Loan History: These loans require that all government loans in the past have no delinquencies or defaults.

The definition of the term "small business" may differ by industry but mostly refers to size concerning either annual receipts or the number of employees. For example, about the number of employees, the size standards might amount to less than $1 million of annual revenues to more than $40 million, depending on the industry, or from less than 100 employees to more than 1,500 employees.

Other requirements include a solid credit score and a clean financial history free of business-related losses to the government. Business owners who are incarcerated, on parole, or have a recent felony indictment are ineligible for SBA financing.

We understand this at Commercial Loan Link and will leave no stone unturned to be able to bring you the best available lenders and terms to service your business. Contact us for assistance to secure an SBA loan.

Let us help guide you through the financial maze in a manner that lets you know, beyond any doubt, that you have the support and the resources necessary for success.

Learn How To Expand Your Business With An SBA Loan

Commercial Loan Link enables company owners to realize their full potential and broaden their horizons with targeted SBA loans.

As experts in connecting businesses with the finest financial solutions, we understand that the right loan can fuel development and boost your market position.

Here are some reasons why SBA loans for business might be an excellent choice for you:

Versatile Funding Options: SBA loans may be tailored to your requirements, from land acquisition, commercial real estate purchase and new construction to renovations of existing building and equipment acquisitions. These loans are a key part of commercial real estate financing, especially through SBA 7(a) and SBA 504 loans, which offer various advantages and conditions for borrowers.

Extended Payback Terms: Take advantage of payback terms intended to help you manage your cash flow while giving your new or expanding facility the time it needs to become successful.

Lower Down Payments: Unlike typical loans, you will pay less upfront, freeing funds to spend directly on the company’s growth.

Competitive Interest Rates: With the SBA’s support, you may enjoy lower interest rates, which translates into cost savings throughout the life of your loan.

Accessibility To New Entrepreneurs: Break down entrance barriers with SBA loans, suitable for entrepreneurs with strong company concepts but minimal financial experience.

Expansion Opportunities: Leverage steady demand in urban and suburban locations to expand your business, with SBA loans providing the necessary money for smart economic development.

Recession-Resistant Investment: Invest in a sector recognized for its stability, even during downturns, making it an appealing option for lenders using SBA-backed security.

If you are ready to use an SBA loan to change your company, Commercial Loan Link can help you navigate the process.

Our staff is happy to help you navigate the complexity of loan acquisition, ensuring that you maximize the benefits of SBA financing.

Contact us now to begin a discussion that might change the course of your company.

Let us open the doors to new possibilities together, guaranteeing that your company develops and thrives in its market.

Master SBA Loan Compliance For Your

Rental Properties With Our Help

Navigating the tricky world of SBA loans can get scary, especially regarding rental property financing. At Commercial Loan Link, we make the process easier for small business owners. Our highly qualified and experienced SBA loan broker team is dedicated to holding your hand through the loan process, ensuring that you meet the specific owner and occupancy requirements and, in the process, receive the best terms available.

The main condition for real estate to qualify for SBA loans is that it be largely owner-occupied. This means that homes normally managed by investors with tenants who pay rent are not eligible. Instead, the property must be used primarily by your small business.

When using an SBA loan to buy an existing commercial real estate facility, your business must use at least 51% of the space. Your company should occupy at least 60% of the space in new structures sponsored by the Small Business Administration.

Self-storage facilities, RV parks, and executive office suites sometimes blur the distinction between small companies and investment assets. However, the SBA considers companies eligible for financing because they operate on a business model beyond just space leasing, providing additional services that qualify them as small enterprises.

Eligible small business assets include, among other things, auto repair shops, car washes, clinics, and restaurants.

If you want to use SBA loans for rental property in Hawaii, Tennessee, or elsewhere, working with Commercial Loan Link is the first step toward obtaining advantageous financing. We specialize in taking you through the guidelines stated by the SBA to help customize a loan expressly meant to offer coverage for your particular business needs.

Please contact us and we will discuss how we can make it a reality for you to obtain SBA loans to help achieve growth and stability in your business.

At Commercial Loan Link, we are more than loan brokers; we are partners in your business success.

We work with you to help expand your operations using the right financial resources.

We simplify financing, allowing you to focus on what you do best-running your business.

Uncover Strategic Financing For Your

Rental Properties With Our SBA Loan Expertise

At Commercial Loan Link, we realize how the right financing can make all the difference to your rental property business. Trying to find your way around the financial world can be quite a dizzying mess.

That is where we come in. As dedicated loan brokers, we specialize in connecting rental property company owners with the best SBA loans, guaranteeing you the flexibility and return on investment that regular bank loans frequently do not provide.

There are numerous reasons why small rental property owners may select SBA financing over regular bank loans. One of the most significant advantages is the flexibility in down payment and collateral requirements.

Unlike regular bank financing, SBA loans often have far lower down payments, allowing you to keep more cash for business growth. Additionally, whereas banks frequently require substantial collateral before obtaining a loan, SBA loans do not, considerably enhancing your chances of success.

SBA loans also provide the advantage of longer payback periods. SBA real estate loans can be repaid over a 25-year term, while working capital and equipment loans can be returned over up to ten years.

Traditional bank loans, on the other hand, frequently have shorter repayment periods and require annual loan term reviews and renewals. This is problematic since economic changes or bank ownership could impact your loan renewal, leaving you with a balloon payment.

Choose Commercial Loan Link as your broker, and get capable advice.

Our expertise in SBA loans will bring you terms most fitting for your company's particular needs and growth trajectory.

Do not let the SBA loans confuse or concern you; our team is here to help.

Please contact us today to get started on your path toward financial success with an SBA loan.

Drive Commercial Growth With

Comprehensive SBA Loan Brokerage

Commercial Loan Link helps to make the path towards property ownership smoother and more accessible for small businesses with

SBA loans for commercial property. Suppose your business is located in the beautiful landscapes of Idaho or elsewhere in the United States and you want to buy, build, renovate, or refinance your commercial real estate space. In that case, certainly, you will have the best alongside you to help you navigate the complexities of SBA financing.

An SBA loan can largely catalyze the growth of your business, assisting you in the procurement of physical assets such as office buildings, warehouses, retail stores, or hotels. This loan requires that the nature of the business in which you invest be for-profit and operate within the US or its territories.

You would have to prove that your net worth is below $15 million and is tangible, considering an average net income of less than $5 million after taxes in the previous two years. With space, your business should at least be 51% occupied by the borrower, while the rest can be rented out, but for the new building to be considered, it should be at least 60% occupied. Great credit scores and high-flying business plans will also bring you closer to eligibility.

Navigating these requirements could seem daunting, but this is where our specialists at Commercial Loan Link step in.

With our experienced brokers, we remove the confusion from securing your loan, and at each step, we are certain all the required criteria are met for your loan to close successfully.

We are not just transaction facilitators; we are interested in seeing your business flourish, and we would be glad to hear from you when you take the next step for your SBA loans.

The future of your business starts with a solid foundation, and we help you lay it out.

Achieve Your Property Goals With Our

Specialized SBA Loan Services

At Commercial Loan Link, we believe in helping small businesses build a sound, growing operation with the financial products they need. If the next step is to enhance your commercial real estate, let our expert brokerage staff make it easier.

We are experts in SBA loans for commercial real estate, and we ensure you receive the best rate on the market.

SBA loans can be used for existing buildings, and prospective borrowers must demonstrate at least 51% owner occupancy for existing buildings to qualify.

Imagine having a fixed-rate loan that lets you confidently predict your mortgage payments, low down payment requirements that keep your cash flow intact, and the ability to roll soft costs into your loan.

These are just some advantages of the SBA 504 loan program, tailored to help small businesses like yours thrive.

With terms extending up to 25 years and interest rates that remain low even when fees are included, SBA 504 loans offer a stable, long-term solution for your commercial real estate needs.

So, if you are considering taking an SBA loan on your commercial real estate, let Commercial Loan Link be your guide.

Our experience as loan brokers results in a highly personalized, hands-on level of care that keeps you going smoothly through the financing process. We are here to help you determine your eligibility, structure your loan to match your financial needs, and ultimately secure the funds that will allow your business to prosper.

Are you prepared to take the next step in obtaining the ideal loan for your commercial real estate needs?

If so, connect with Commercial Loan Link to discuss your ambitions and explore how SBA 504 loans can help you meet them.

Create a brighter future for your business with us.

Button

Button Button

Button

Navigate Medical Practice Financing With Ease:

Discover SBA Loan Options With Us

Are you a doctor looking to finance or grow your practice? Commercial Loan Link specializes in connecting you to the best financing options available. Our experience in SBA loans for physicians guarantees that you get the specialized financial assistance you need to prosper in today's competitive healthcare industry.

SBA 7(a) loans are useful for doctors looking for medical practice financing for various objectives, such as acquiring or expanding a practice, purchasing a facility, refinancing existing loans, or financing medical equipment as part of a broader lending program.

These SBA loans are intended to provide medical professionals with the flexibility and assistance they need to deal with the special issues they confront.

SBA 7(a) loans may be used by physicians to meet various purposes, including:

- Buy medical equipment

- Building acquisition, refinancing, or construction

- Refinance your medical practice

- Medical practice growth

- Partner buyout

- Equipment finance, particularly when included in a bigger loan

Our network of SBA lenders specializes in medical practice financing and helps various practice types, including physical therapy clinics, pharmacies, and specialties such as dentistry, veterinary care, ophthalmology, and optometry.

Furthermore, successful chiropractic companies, concierge practices, and functional medicine clinics may get funding via SBA loans nationwide.

Choosing Commercial Loan Link means working with a staff that understands medical professionals' unique requirements and is committed to getting you the best loan terms possible.

Our experience with SBA loans assures a quick process, allowing you to focus on providing excellent patient care.

Are you prepared to take your medical practice to the next level?

Contact Commercial Loan Link now.

Allow us to assist you in obtaining the financing needed to develop and improve your medical practice.

Secure Your Practice’s Future With

Specialized SBA Financing

Commercial Loan Link provides unparalleled assistance to physicians who want to develop or expand their medical practices.

We specialize in connecting healthcare professionals with the best financing options, concentrating on SBA loans that are tailored to your needs. You will always have us by your side, whenever you access such invaluable resources that support you in taking your practice to the next level.

The SBA 504 loan program supports larger projects like real estate purchases or the acquisition of substantial equipment, which is useful for businesses.

This program is designed to finance up to 90% of the project cost from land acquisition, commercial building renovation, and durable medical equipment purchases.

Are you planning to make major investments in your facility?

SBA 504 loans can be a valuable tool to help offer low fixed rates for long terms—no balloon payments or future refinancing needed—adding an element of stability and predictability to your financial planning.

If you want to include energy-efficient modifications, the SBA 504 loan may enable you to finance up to $5,500,000 with just a 10% equity input, making it an excellent alternative for large-scale projects.

On the other hand, SBA 7(a) loans are versatile and recognized for their minimal down payment requirements, making them suited for a wide range of financial demands in the medical sector, from small upgrades to managing day-to-day operations expenditures.

Commercial Loan Link can assist if you are ready to expand your medical practice with SBA loans.

We are dedicated to providing the best financing option for your requirements and ensuring the successful development of your business.

Contact us now to see how SBA loans may help expand your medical facility.

Overcome SBA Loan Complexity With

Top-Rated Brokerage For Your Law Firm

Commercial Loan Link specializes in brokering

SBA loans for law firms, ensuring that legal practices from California to New York have the financial resources they need to expand and thrive.

We assist you in negotiating the complexities of many financing options and getting the best aligned terms with your firm's strategic goals.

We do not provide loans directly; rather, we connect law firms with a network of lenders that may meet practice financial needs.

SBA loans for legal firms are especially beneficial because:

Flexible Financing Options:

These loans provide up to 100% financing for purchasing subsequent practices, allowing you to acquire your first company with as little as 10% down. This adaptability is critical for legal firms in SBA loans, as market dynamics may require quick expansion without a large upfront investment.

Better Periods And Rates: Compared to conventional financing, SBA loans have more competitive rates and longer payback periods, as well as lower collateral requirements, making them a financially viable solution for law firms looking to enhance operational efficiency and profitability.

Proven Track Record: Since 2020, more than $430 million in SBA 7(a) loans have been approved to more than 1,000 law offices statewide, demonstrating the loans' efficacy in supporting the development and profitability of legal practices.

Understanding the distinct financial environments of SBA loans enables us to navigate specialized requirements and possibilities.

You will work with a professional team that will simplify each stage, guaranteeing a seamless transition and a successful financing experience for your firm by choosing Commercial Loan Link as your broker.

Allow us to assist you in obtaining the appropriate SBA loan to help your firm grow.

Reach out

to discuss how we can support your development objectives and help alter your legal practice.

Unlock New Opportunities For

Your Law Firm With

SBA Loans

Running a successful law firm has unique obstacles and hefty expenditures. Commercial Loan Link understands these expectations and specializes in connecting legal firms with the appropriate financing solutions, including SBA financing programs such as

SBA loans Illinois,

SBA loans Ohio, and

SBA loans Utah

among others. SBA loans help you start a new practice or expand an existing one.

SBA loans

are often used in the legal area to preserve a professional reputation, support marketing initiatives, pay litigation expenses, and facilitate company acquisitions. Law companies need elegantly furnished offices, competent and licensed personnel, and participation in relevant associations to retain credibility and professionalism. These components are pricey yet necessary for customer trust and company success.

Marketing initiatives are an additional substantial investment for law companies. While word-of-mouth is important, many businesses rely on digital advertising, television, and radio to attract new customers and top-tier candidates. Financing these advertisements may help law firms reach a larger audience and acquire more clients.

SBA loans

are also increasingly being utilized to fund sophisticated legal work related to cases that lawyers hope to win. These loans are secured by a future decision or settlement, and provide the money required to handle high-stakes legal fights efficiently.

Furthermore, shifting demographics and the retirement of senior attorneys provide chances for company acquisition and development.

SBA loans may offer the capital needed to establish new practices or expand existing ones, allowing legal firms to develop strategically.

Using the SBA 7(a) Loan Program is one of the most efficient methods for law firms to get the money they need.

Understanding which areas of your practice would benefit the most from financing—whether it is maintaining professionalism, launching marketing initiatives, managing litigation costs, or expanding through acquisitions—will help you increase your chances of approval and secure the funds you need to succeed.

Contact Commercial Loan Link now

if you are ready to learn more about how SBA loans might help your law firm.

Slide title

Button

Button

Slide title

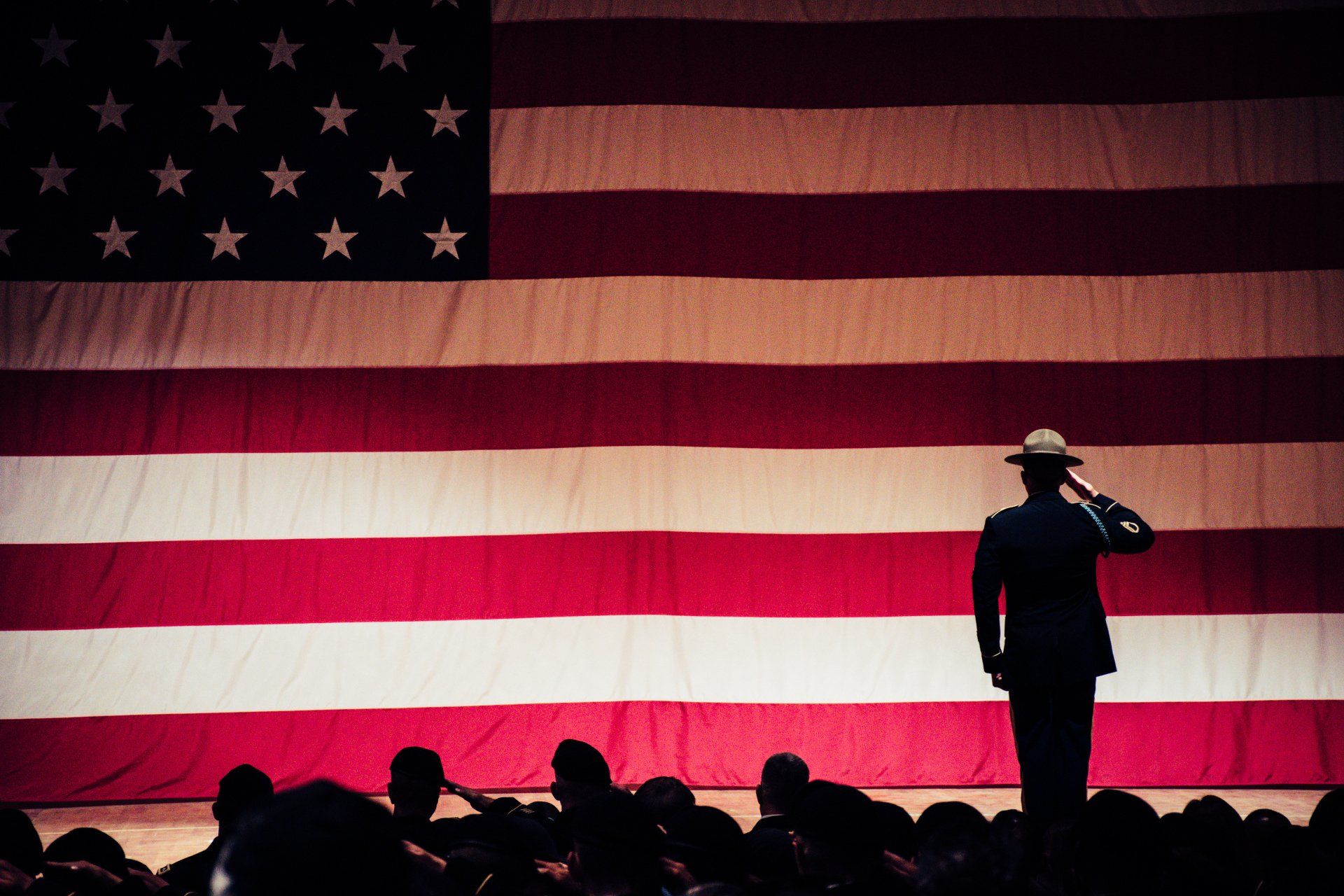

Secure SBA Express Loans Efficiently With Our

Expert Brokerage Services For Veterans

At Commercial Loan Link, we specialize in providing veterans and their families with critical financial resources via

SBA loans for veterans.

As a commercial loan broker, we help customers nationwide, walking you through the alternatives to guarantee you discover the right loan to move your company ahead.

The

SBA Express loan program is useful to veterans since it has a simplified approval procedure.

Decisions are often made within 36 hours, enabling you to assess your financial situation and determine your future moves.

Although it may take longer to obtain the cash, knowing your approval status early allows you to plan for your business's requirements without delay.

These SBA loans Oklahoma have a ceiling of $500,000 and periods of up to 10 years. They are intended to help veteran-owned companies expand and maintain themselves.

SBA Express loans are usually offered at a different interest rate than what is charged in a traditional SBA 7(a) loan since it is only a certain percentage of the loan amount that the government guarantees.

Other requirements for determining the fee discounts of a qualifying business on

SBA Express loans include a 51% or more ownership by a veteran who has not received a dishonorable or bad conduct discharge, a veteran with a service-connected disability, an Active Duty Military service member participating in the Transition Assistance Program, a reservist or National Guard member, or the current spouse (or widowed spouse) of one of these individuals.

Veterans benefit from no upfront fees on these SBA loans, greatly lowering the initial expenses of obtaining business funding.

This advantage may make a difference in the early stages of company growth.

If you are a veteran or the spouse of a veteran seeking SBA loans, Commercial Loan Link is here to help.

Our thorough expertise in the loan application procedure enables us to make your road to obtaining a loan as smooth as possible.

Contact us now to see how we can help your company develop and take advantage of the special benefits offered to veterans.

We are thrilled to collaborate with you and ready to see how your company can thrive with the correct financial backing.

Find The Right SBA Loan Path For

Your Veteran-Owned Business

Commercial Loan Link is committed to empowering veterans and small business owners by providing financial growth and security.

As your loan broker, we will professionally assist you through the various financing choices available, focusing on SBA loans for veterans to ensure you get the best possible rates and terms.

We are here to provide individualized help every step of the way, whether your company is starting in Oregon, growing in Missouri, or expanding in Kansas City.

Securing capital can be especially difficult for first-time entrepreneurs.

Lenders often prefer established companies with good cash flow, which excludes startups with less than a year of operation.

However, veterans and other small-business owners have attractive options with SBA loans:

SBA Microloan Program: The SBA funds this program, which is intended for startups and early-stage firms. It provides small-scale loans up to $50,000. Loan periods can be up to six years, and fees are limited to 3% of the loan amount plus closing costs as specified by the lender. Borrowers are often required to provide collateral and sign a personal guarantee. Eligibility requirements differ amongst lenders, with some needing a minimum credit score.

SBA Community Advantage Loan: Part of the wider 7(a) program, the Community Advantage loan is intended for emerging companies, those in traditionally risky industries, and enterprises controlled by women, minorities, and veterans. Unlike regular SBA 7(a) loans, these are frequently provided by certified development corporations, microloan programs, and other groups. Borrowers may borrow up to $350,000, with the SBA guaranteeing up to 85% of the loan. Repayment of ten years for equipment and working capital and twenty-five years for real estate. This SBA loans Kansas City is especially beneficial to entrepreneurs.

If you are a veteran or a small company owner in Oregon, Missouri, Kansas or any other state in our great nation, let Commercial Loan Link help you find the finest SBA loans for veterans.

Our understanding ensures you receive the most advantageous terms and conditions tailored to your company's needs.

Contact us now, and we will be more than happy to help you on your way to success by providing assistance and tools needed for each stage.

Write your caption hereButton

Write your caption hereButton Write your caption hereButton

Write your caption hereButton

Slide title

Navigate SBA Loan Acquisition For

New Ventures And Existing Facilities

Commercial Loan Link helps entrepreneurs enter the self-storage industry, whether they are developing a new facility or buying an existing one.

As your commercial loan broker, we can walk you through the complexity of obtaining the correct SBA loans for self storage facilities to meet your business needs.

Constructing a new self-storage facility involves significant initial costs.

Acquiring land and navigating the complexities of zoning approvals and permits can extend timelines and increase expenses.

However, a major perk of developing a new facility is the ability to tailor the design and features completely to your specifications to meet local market needs and modern demands. But expect a ramp-up phase to grow customers, which may influence cash flow in the early stages.

Buying an established facility can provide instant cash flow from an existing consumer base as well as a proven track record, which can be desirable to lenders. It has the potential to improve operational efficiency, hence increasing profitability.

However, comprehensive due diligence is required to analyze existing debts, the facility's status, and any liabilities.

Although it may have considerable initial expenses, it is frequently less expensive than starting from scratch when factoring in the time value of money and rapid cash generation.

Whether starting a new business or taking over an established one, Commercial Loan Link can assist you in negotiating the financial landscape.

We specialize in connecting businesses with the best SBA loans and other financing solutions, ensuring that you receive advantageous terms and help throughout the process.

If you are ready to investigate the possibilities in the self-storage market, contact the SBA loan specialist at Commercial Loan Link immediately.

Reliable SBA Loan Brokerage For

Your Self-Storage Business Growth

Commercial Loan Link is able to obtain SBA loans for self-storage facilities, assisting you in starting, acquiring, or expanding your facilities.

Our extensive network of lenders is well-versed in the SBA loans process, and we provide a range of packages tailored to the specific needs of your self-storage business.

The SBA 7(a) loan programs are designed to have flexibility if you wish to start or grow your self-storage businesses. It will allow acquiring land or buildings, paying for construction expenses, or refinancing existing debt. It is a viable option if you plan to expand. This flagship program is highly versatile and can be customized to meet any fund requirement.

On the other hand, the most appropriate SBA self storage loans for projects with huge fixed asset requirements, such as real estate or purchases of equipment on a larger scale, is the SBA 504 Loan Program.

The set of programs is designed for those interested in acquiring or developing a new facility, and they offer long-term, fixed-rate financing to support large investments.

SBA 504 loans are specifically designed for real estate projects, outlining requirements for both existing and new real estate projects to qualify for financing.

The SBA Microloan Program may be just the ticket for those with less than major requirements or who need less financing. It provides up to $50,000 to help fledgling firms cover less significant costs and stay on their feet.

Choosing Commercial Loan Link means working with a staff that knows your sector and delivers customized attention to ensure that the finance solution we arrange aligns with your company objectives.

We take time to fully understand your operations and goals, ensuring that the financial plan implemented aligns with your long-term vision.

Are you ready to learn how SBA loans could help your self-storage business?

Get in touch with Commercial Loan Link today.

Our experts will accompany you through the whole loan application process, from consultation to final approval and funding, assuring a positive experience.

Allow us to help you maximize the potential of your company.

Button

Button

Slide title

Button Write your caption hereButton

Write your caption hereButton

Slide title

Steer Your Trucking Business To Success With Our

Professional SBA Loan Assistance

At Commercial Loan Link, we are committed to assisting truckers and transportation companies in navigating the difficult finance market.

We can help you as an SBA loan broker to source SBA loans for your needs.

The government of the United States fully backs up these loans, and for such a long time, many trucking companies have liked the loans because the interest rates attached are low, minor to put down, and long repayment terms.

Some will range from $30,000 to $5 million—a flexible range of costs that could help keep your business afloat and expand.

SBA loan for trucking company can take many forms, each customized to a particular need.

The SBA 7(a) loan program provides guaranteed lending up to $5 million with SBA guarantees at 85% for loans of $150,000 and below and at 75% for those over $150,000.

The repayment period extends to 25 years for commercial real estate loans, 10 years for equipment loans, working capital and inventory loans.

SBA Microloans are perfect for modest expenses like travel, supplies, and marketing. You may apply for up to $50,000, with the average loan awarded under this program being roughly $13,000, and the conditions allow for payback over six years.

While SBA loans have several advantages, obtaining them necessitates a demanding application procedure that normally requires a strong credit score, a well-structured business plan, and a stable corporate structure.

Commercial Loan Link, as your loan broker, is here to help you streamline the process.

We walk you through every step, from knowing the criteria to producing a convincing application, ensuring you have the greatest opportunity to obtain the cash you need.

If you are ready to take the next step in obtaining SBA loans for trucking companies to fuel the expansion of your trucking company, contact Commercial Loan Link immediately.

We are here to guide you in connecting with the proper lenders and achieving a finance solution that suits your company's objectives.

Contact us to discuss your financial requirements and let us help you direct your company to success.

Button

Button Button

Button Write your caption here

Write your caption here

Expand Your Fleet With

Flexible SBA Financing Solutions

Commercial Loan Link is helping trucking company owners expand their assets and capabilities, particularly through SBA trucking loans such as the SBA 504 loan program. This program is intended to purchase fixed assets such as real estate, land, and heavy equipment. While it does not often cover car purchases, some heavy equipment vehicles used in transportation are eligible.

The vehicles financed through the SBA 504

commercial truck loans are cement, dump, trailer, and tanker trucks. Other vehicles of a smaller nature, like pick-up trucks used for equipment transport or other tools, do not fall under this program.

Beyond vehicle buying, the SBA 504 loan may help your trucking company in various ways. It may be used to acquire or build operating areas such as parking lots, repair facilities, or warehouses, necessary for your fleet to function efficiently.

Furthermore, the loan may assist with the maintenance equipment cost and supplies, ensuring that your fleet is constantly in good condition and decreasing downtime.

As your business grows, the flexibility of SBA loans allows you to expand your operations.

This might mean purchasing extra vehicles and trailers or expanding your facility to accommodate rising demand.

Investing in these areas supports your immediate operational needs and positions your company for future growth and success.

At Commercial Loan Link, we can help guide the way in obtaining an SBA 504 loan by advising on how to apply for or leverage the financing. Our team of professionals will always stand ready for support at each step.

Contact Commercial Loan Link if you are ready to take your trucking company to the next level with SBA 504.

We are excited to discuss how this financing may alter your company's operations and help you accomplish your long-term objectives.

Let us discuss your financial requirements that will help propel your company into a bright future.

Interested in our services? We’re here to help!

We want to know your needs exactly so that we can provide the perfect solution. Let us know what you want and we’ll do our best to help.

Links

Contact Info